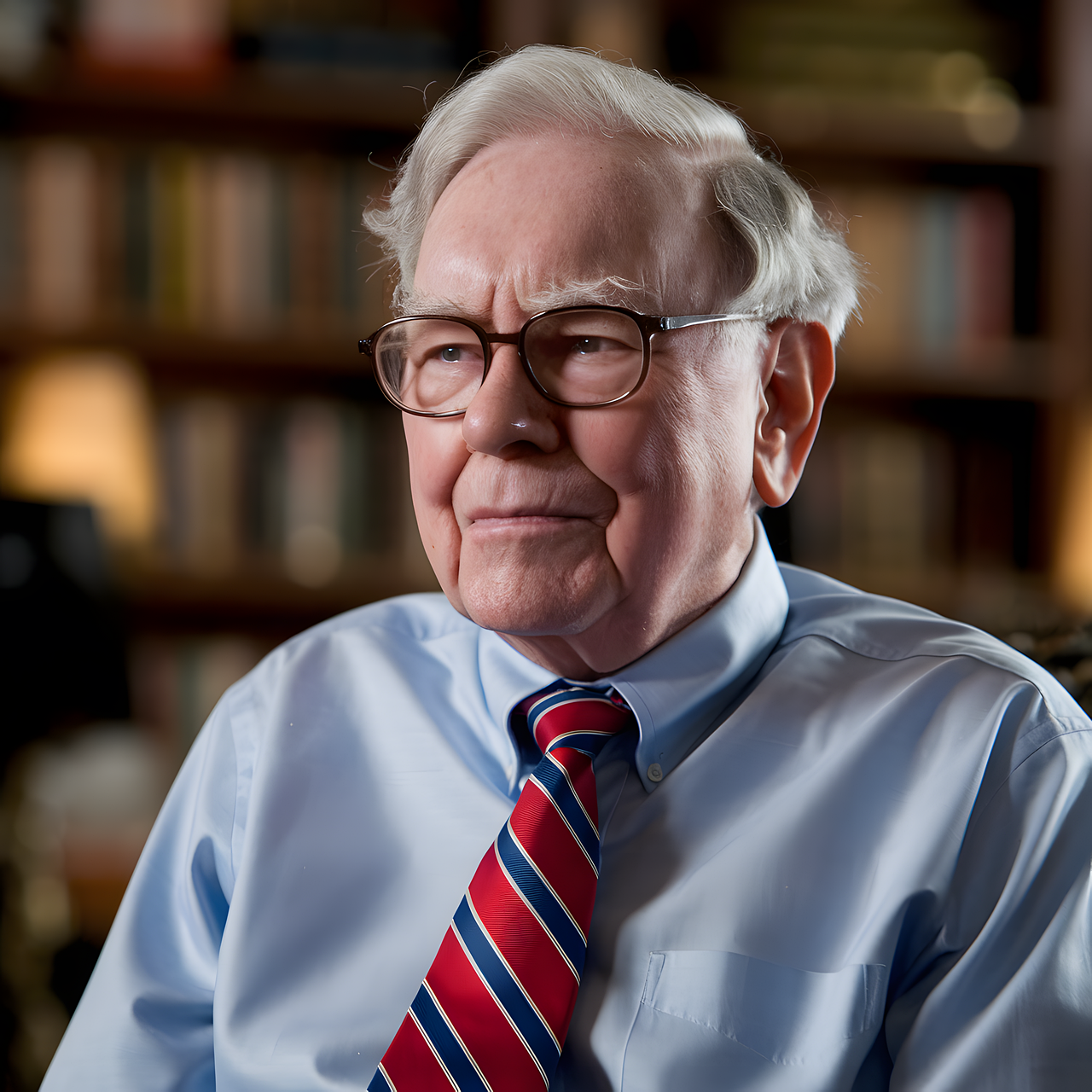

As the 21st century dawned, Warren Buffett stood at the pinnacle of financial success, having transformed Berkshire Hathaway into one of the most formidable conglomerates in the world. With a net worth that consistently placed him among the wealthiest individuals on the planet, Buffett’s reputation as an investment guru and a benevolent philanthropist was firmly established. However, the new century also brought unprecedented challenges and shifts in the global economy that would test Buffett’s investment acumen and his commitment to his long-held principles.

The Impact of September 11 and the Financial Crisis of 2008

The early years of the 21st century were marked by significant events that would shape the economic landscape. The most shocking of these was the terrorist attacks on September 11, 2001. The attacks led to a substantial downturn in the stock market and created a climate of uncertainty that reverberated throughout the financial sector. As companies reeled from the aftermath, many investors fled to the sidelines, fearing further losses.

Warren Buffett, however, remained resolute. He saw the chaos of the post-9/11 world not as a reason to panic but as an opportunity to identify undervalued companies. His philosophy of long-term investing guided him through these tumultuous times. Buffett understood that while the market was reacting emotionally to immediate crises, the underlying fundamentals of many businesses remained strong.

In 2008, the financial crisis hit, presenting another severe test for investors worldwide. The collapse of Lehman Brothers and the subsequent bailout of major financial institutions sent shockwaves through global markets. The crisis was a stark reminder of the risks inherent in the financial system and how quickly fortunes could be lost.

Buffett’s Response to the Crisis

During the financial crisis, Buffett’s steady hand was evident once again. He famously stated, “Be fearful when others are greedy and greedy when others are fearful.” This mindset prompted him to seek out opportunities in the midst of widespread panic. He made significant investments in companies that were undervalued due to market fear rather than poor fundamentals.

One of Buffett’s most notable investments during this period was in Goldman Sachs. In September 2008, as the investment bank faced dire challenges, Buffett stepped in with a $5 billion investment. He received preferred stock with a hefty dividend, providing immediate capital to Goldman Sachs at a time when liquidity was scarce. This strategic move not only benefited Buffett financially but also lent credibility to Goldman Sachs and the broader financial system, signaling confidence when it was most needed.

Buffett also invested in General Electric (GE) during the crisis. In October 2008, he announced a $3 billion investment in GE, providing the industrial giant with essential capital to navigate the economic storm. Buffett’s actions during this period exemplified his philosophy of buying when others were selling, as he capitalized on fear-driven price declines to acquire quality businesses at attractive valuations.

The Rise of Technology: Embracing Change

As the 21st century progressed, technology continued to transform the global economy, fundamentally altering how businesses operated. Initially, Buffett remained skeptical about investing in technology companies. He famously missed out on early investments in companies like Amazon and Google because he didn’t fully understand their business models or the long-term potential of the internet.

However, as technology became increasingly central to everyday life and business operations, Buffett began to embrace the sector. In 2011, he made headlines when Berkshire Hathaway invested $10 billion in IBM, believing in its ability to innovate and provide valuable services to businesses. This marked a significant shift in Buffett’s approach, as he recognized the potential of technology companies to drive growth and transformation.

Despite this newfound interest in tech, Buffett continued to emphasize the importance of understanding a business before investing. He reiterated his belief that investors should stick to their areas of competence and not chase trends simply because they are popular. This careful approach to investing allowed him to navigate the rapidly changing technological landscape while remaining true to his principles.

The Philanthropic Journey Continues

As Warren Buffett’s wealth continued to grow, so did his commitment to philanthropy. In 2010, Buffett and Bill Gates launched the Giving Pledge, a commitment by the world’s wealthiest individuals to give away the majority of their fortunes to charitable causes during their lifetimes or in their wills. This initiative aimed to inspire billionaires to use their wealth to address pressing global issues such as poverty, education, and healthcare.

Buffett himself pledged to donate 99% of his wealth to charitable organizations, primarily through the Bill & Melinda Gates Foundation. His philosophy on giving was deeply rooted in his belief that wealth comes with a responsibility to give back to society. He often emphasized that philanthropy should be strategic and focused on creating meaningful impact rather than simply writing checks.

In the years that followed, Buffett’s charitable contributions soared. His donations have supported various causes, including education, healthcare, and efforts to combat climate change. He has often encouraged fellow billionaires to prioritize philanthropy, believing that the collective impact of their giving could lead to transformative changes in society.

The Legacy of a Value Investor

As Warren Buffett continued to lead Berkshire Hathaway, he remained committed to his investment principles. His annual letters to shareholders became renowned for their insights into the economy, investing, and business ethics. Buffett’s candid writing style and ability to explain complex concepts in simple terms endeared him to both seasoned investors and newcomers alike.

In 2018, Buffett celebrated a significant milestone—his 50th anniversary as CEO of Berkshire Hathaway. Under his leadership, the company had grown from a struggling textile manufacturer into a multi-faceted conglomerate with a market capitalization exceeding $500 billion. The company owned a diverse array of businesses, including BNSF Railway, GEICO, Duracell, and NetJets, among many others.

Buffett’s influence extended beyond Berkshire Hathaway. He became a mentor to countless investors, offering guidance on how to approach investing with discipline, patience, and integrity. His principles have inspired a generation of investors, reinforcing the idea that success in the stock market is less about speculation and more about sound decision-making based on thorough analysis.

Facing Criticism and Embracing Transparency

Despite his immense success, Buffett faced criticism over the years, particularly regarding Berkshire Hathaway’s reliance on traditional industries and its slow adaptation to emerging trends. Critics argued that his cautious approach to investing in tech companies could hinder the company’s growth in a rapidly evolving market.

In response, Buffett remained transparent about his investment strategy. He acknowledged that he had missed some early opportunities in the tech sector but emphasized that he would not compromise his principles for the sake of short-term gains. His steadfast commitment to value investing, even in the face of criticism, showcased his integrity and conviction.

Buffett also became more open about his investment decisions and the rationale behind them. He embraced transparency, often sharing insights into his thought process during annual meetings and shareholder letters. This willingness to communicate candidly with shareholders reinforced the trust that many investors had in him.

A Vision for the Future

As the 21st century approached its third decade, Warren Buffett continued to lead Berkshire Hathaway with a clear vision for the future. He understood that the world was changing rapidly, and he remained committed to adapting his investment approach while staying true to his core principles.

Buffett also recognized the importance of succession planning. In the years leading up to the 2020s, he began to identify and mentor potential successors within the company. He wanted to ensure that Berkshire Hathaway would continue to thrive long after he stepped down. Buffett emphasized the importance of finding leaders who shared his investment philosophy and values, creating a legacy that would endure.

A Lasting Impact on Investing and Philanthropy

Warren Buffett’s journey through the 21st century exemplifies the challenges and triumphs of a true investing legend. His ability to navigate crises, embrace change, and commit to philanthropy has solidified his status as one of the most respected figures in finance. He remains a beacon of wisdom and integrity in an industry often characterized by volatility and speculation.

Buffett’s legacy is not only measured in the wealth he has amassed but also in the impact he has made on countless lives through his philanthropic efforts. His dedication to giving back, coupled with his unwavering commitment to value investing, has inspired a generation of investors and philanthropists alike.

As Warren Buffett continues to chart his course through the complexities of the modern economy, his story serves as a powerful reminder that success is built on a foundation of principles, patience, and the willingness to adapt to an ever-changing world.